DALLAS

Editor’s Note: Markets experienced a greater-than-1% decline in the market on Monday, January 27. The streak mentioned in the 7th paragraph ended after 74 days, driven by fears about the economic impact due to the spread of the Coronavirus.

Markets continued their winning ways last week, closing at or near record highs. While the Dow Jones Industrial Average closing above the 29,000 mark for the first time captured headlines, the broader S&P 500® Index also hit highs, buoyed by the promise of continued low interest rates courtesy of the Federal Reserve and the signing of the first phase of a trade deal between the United States and China.

While market highs are a good thing, stocks rallied last year based on several factors, the most prominent being the Federal Reserve rate cuts, said David Spika, chief strategic investment officer of GuideStone®. To continue on an upward growth pattern will require a rebound in corporate earnings growth and an improved global economy leading into the November 2020 election cycle, Spika said. The likelihood of stronger earnings and economic growth is tempered by the age of the current economic cycle, which at 11 years is several years longer than the historical average.

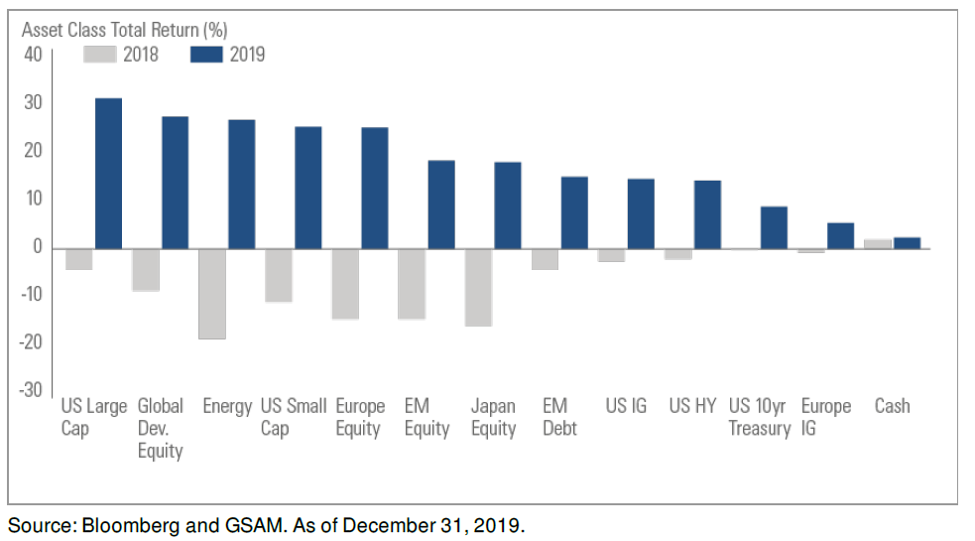

“We had a tremendous year in the markets in 2019,” Spika said. “It is very difficult to repeat those kinds of years. The market was propelled by the Fed rate cuts, and that is unlikely to be replicated in 2020. Virtually every asset class had strongly positive returns in 2019, which is not the norm; in 2018, for example, almost all asset classes had negative returns [see chart below].”

Retirement plan investors should use the start of the year as a time to look at their portfolios and ensure they are not overweight in certain categories and underweight in others, which could exacerbate the effects of a market decline. GuideStone participants can receive help with their long-term investment allocations by accessing the resources on the Retirement Planning and Guidance page, which include GuideStone’s Investment Recommendation tool.

Investors in GuideStone’s MyDestination Funds® do not have to make reallocations as those Funds rebalance as part of their structure, though an annual review to ensure an investor is allocated appropriately to meet his or her goals is always a wise use of time, GuideStone President O.S. Hawkins said. The MyDestination Funds Target Date Funds provide a simpler approach to retirement planning. Investors simply choose the Fund that corresponds most closely to their retirement date. Each Target Date Fund is a “fund-of-funds” with a diversified asset allocation that’s more aggressive when the investor is younger and gradually becomes more conservative as the investor approaches and moves through retirement.

“We never want to encourage anyone to try to time the market,” Hawkins said. “Looking at your portfolio, ensuring that it is properly diversified given your time horizon and risk tolerance, and then — and only then — making strategic, focused changes, if needed, is a smart way to ensure you’re prepared for an eventual downturn in the markets.”

Spika noted that GuideStone’s managers have taken some gains in the mutual funds following these powerful market advances, which is prudent to do given the age of the cycle. In addition, markets are probably overdue for a correction, given that the S&P 500 has gone more than 70 days without even a 1% decline, with the last “healthy correction” happening in December 2018. A healthy correction — a decline in the 10% range — generally occurs about once every year.

“Retirement plan investors, especially, need to stay focused on their long-term plan and asset allocation for their long-term retirement needs,” Spika said. “Market fluctuations will occur, and we’re likely overdue for one, but a long-term focus and a diversified investment approach has historically been rewarded by the markets.”

Whether markets continue their climb through 2020 or volatility returns or the market declines, GuideStone experts recommend four basic principles for retirement plan investors:

-30-

_____________

Roy Hayhurst is director of denominational and public relations services for GuideStone Financial Resources of the Southern Baptist Convention®.

Media Contact

Roy Hayhurst

Director of Denominational and Public Relations Services

GuideStone Financial Resources of the Southern Baptist Convention®

Roy.Hayhurst@GuideStone.org | (214) 720-2141

The MyDestination Funds (“Funds”) attempt to achieve their objectives by investing in the GuideStone Select Funds and other investments. The Funds are managed to a retirement date (“target date”) by adjusting the percentage of fixed income securities and equity securities to become more conservative each year until reaching the retirement year and then approximately 15 years thereafter. The target date in the name of the Funds is the approximate date when an investor plans to start withdrawing money. The expense ratio for the Funds includes the expenses of the underlying Select Funds. The principal risks of the Funds will change depending on the asset mix of the Select Funds in which they invest. You may directly invest in the Select Funds and other investments. The Funds’ value will go up and down in response to changes in the share prices of the investments that they own. The amount invested in the Funds is not guaranteed to increase, is not guaranteed against loss, nor is the amount of the original investment guaranteed at the target date. It is possible to lose money by investing in the Funds.

You should carefully consider the investment objectives, risks, charges and expenses of the GuideStone Funds® before investing. For a copy of the prospectus with this and other information about the Funds, please download a prospectus at GuideStoneFunds.com/Funds or call 1-888-GS-FUNDS (1-888-473-8637). You should read the prospectus carefully before investing.