Would you ever leave money on the table? Of course not!

If you aren’t participating in your employer match, you might be missing out on hundreds — if not thousands — of dollars toward your retirement savings!

Here’s the employer match explained — what it means, how it works and why it matters for your retirement savings.

Here’s employer matching explained in simple terms: If you contribute money to your retirement account, your employer will also contribute additional dollars — up to a certain level. And, because most employer matches are calculated as a percentage of your salary, the value of that match will increase as your salary increases during your tenure.

| Employee Annual Contribution: You contribute 6% of your $50,000 salary. |

$3,000 |

| Employer-Matching Annual Contribution: Your employer matches 50% of your own contributions, up to a maximum of 6%. |

$1,500 |

| Total Annual Contribution: Combine your employee + employer-matching contributions |

$4,500 |

Building on the example above, let’s say the employee’s salary increases from $50,000 to $60,000. This increase would affect the employer match amount, as it’s based on a percentage, increasing it from $1,500 to $1,800 annually.

It is a good idea to consult your employer’s Human Resources department to ensure that your contributions are high enough to take advantage of the full employer match. (In this example, the employee would need to contribute at least 6% of his or her compensation to receive the full employer contribution.) Also, check that both your contribution and the match are set up as a percentage, if allowed by your employer, so that they will grow with your salary every year. Flat dollar savings may not optimize your savings as effectively in the long run, since they won’t automatically increase if your salary increases.

Industry experts recommend saving 15% of your income (a combination of employee and employer contributions). But starting with any percentage is better than contributing nothing.

Did you know that the type of retirement contribution(s) you select determines the amount of your tax savings — both now and in retirement?

Most retirement plans offer these two types of contributions:

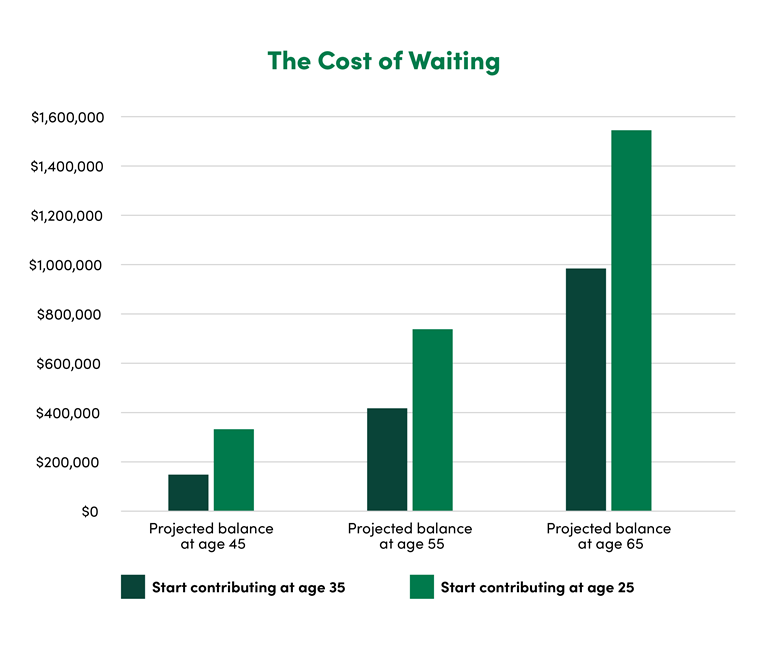

Waiting to begin saving can have a significant negative impact on your retirement outcome due to the power of compound interest. Contribution increases can make a dramatic difference in your retirement balance over time.

The extra money can make a dramatic difference in your retirement account balance over time.

This is a hypothetical example that illustrates the future value of regular monthly investments for different time periods. It is based on two 25-year-olds with a starting salary of $50,000, annually increasing by 3% until age 65. It assumes an annual deferral rate of 12% with an average annual return of 6%. It is presented for illustrative purposes only and does not reflect actual performance or predict future results of any particular account or investment.

To find out if your employer offers contributions to your retirement plan, how to set up your account or how to increase your contributions, contact your human resources department or employer.

If you have questions or need additional assistance, you may contact us at Info@GuideStone.org or 1-888-98-GUIDE (1-888-984-8433), Monday through Friday, from 7 a.m. to 6 p.m. CT.

This information should not be considered tax or legal advice. GuideStone stands ready to assist your organization as you work with your legal and tax advisers by providing resource information that you and your adviser may find beneficial.

*Roth distributions are not taxable if the first Roth contribution in the account has been held for five years and the participant is over age 59½, deceased or disabled.