Engaged couples and newlyweds know that a perfect wedding day doesn't happen without planning ahead. The same can be said of financial life as a married couple.

Money is the most frequent argument for 41% of couples carrying consumer debt. Younger generations are entering marriage with more debt, a trend that has been rising compared to previous generations.*

Honor the Lord.

Proverbs 3:9 states that you are to honor the Lord with your wealth and with the firstfruits of all your produce. In addition to a tithe, Christian couples should decide how much and with what frequency you will support your home church and ministries close to your heart with additional gifts.

Identify your money style.

Share your current money management habits with your spouse or spouse-to-be. Be honest about your tendencies: Are you a spender or a saver, or do you fall somewhere in the middle? Learning to jointly manage your finances will require each of you to play to your strengths and be realistic about your weaknesses.

Develop your goals.

What financial goals will you set as a couple? Do you want to buy a house? Take an overseas mission trip together? Expand your family by having kids or adopting? Discuss your goals and map out a plan to reach them.

Consider sharing your credit reports.

As a married couple, you'll each maintain individual credit scores, but your financial lives will be intertwined. One person with an unfavorable credit history can jeopardize joint accounts, such as mortgages and car loans. Develop a plan to build up your individual scores before diving into joint credit accounts.

Lay out your debt.

Each person should bring a list of his or her debts and other financial obligations, including credit cards, student loans, automobile notes and mortgages, to the discussion. Discover ways to optimize your financial health.

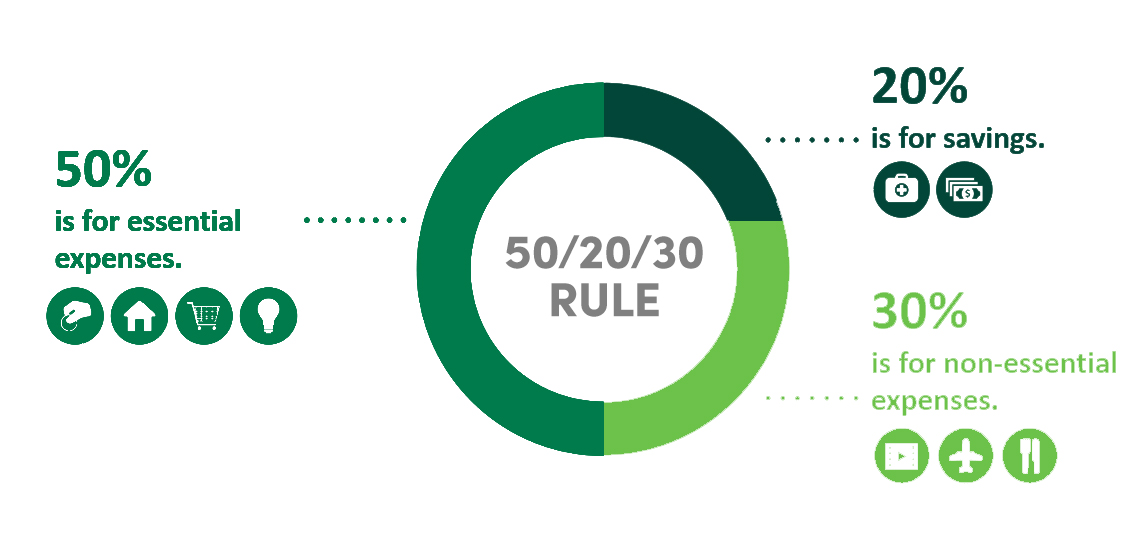

Understanding your responsibilities and setting your financial goals will help you build a plan for your financial resources. If you need help creating a budget, choose one of the popular budgeting programs, such as the FaithFi™ app. You can also refer to the 50/20/30 rule to help you categorize your income.

Designate financial tasks.

Who will be responsible for paying the bills, reconciling the checking account and monitoring investments? Some couples are comfortable having one person in charge of all the tasks, while others prefer to divide them up. Agree on what works for you.

Learn from the experts.

Enroll as a couple in a financial management class. Your local church or community center is a good place to look. American Consumer Credit Counseling also offers a variety of on-site classes and webinars.

Schedule checkups.

Designate a time on the calendar as your reminder to conduct a financial checkup. Your list of discussion items and frequency will change as you purchase a home, raise children, advance in your career and assume responsibilities for aging parents. But even when life gets busy, your checkup needs to be a priority.

Plan for your golden years.

The earlier you plan for your golden years, the better. If your employers offer retirement savings plans, make sure you are saving at least enough to get any employer match (if offered). Make plans to increase your contributions each year until you reach your desired investment level.

Strong communication is an important key to a strong marriage. Talking about your finances now can help you create a strong financial foundation on which to build a happy, long-lasting relationship — and prepare well for retirement!

*RamseySolutions.com/relationships/money-marriage-communication-research