Ministers have a dual tax status:

A minister is considered an employee under the common law rules, but payments for services as a minister are considered income from self-employment.

All employees are required to pay taxes for Medicare and Social Security in some way; the difference is how they pay these taxes.

To learn more about how Social Security rules and taxes apply to ministers during working years, read Ministerial Tax Issues and access our free, annual Ministers’ Tax Guide for our members.

Understand how Social Security will work for you from a long-term perspective.

Drawing Social Security is a matter of time — literally.

As you enter your 60s, you are likely beginning to think about drawing Social Security. After all, you’ve paid into the program for years and are finally eligible at age 62. So why not begin receiving your payment immediately?

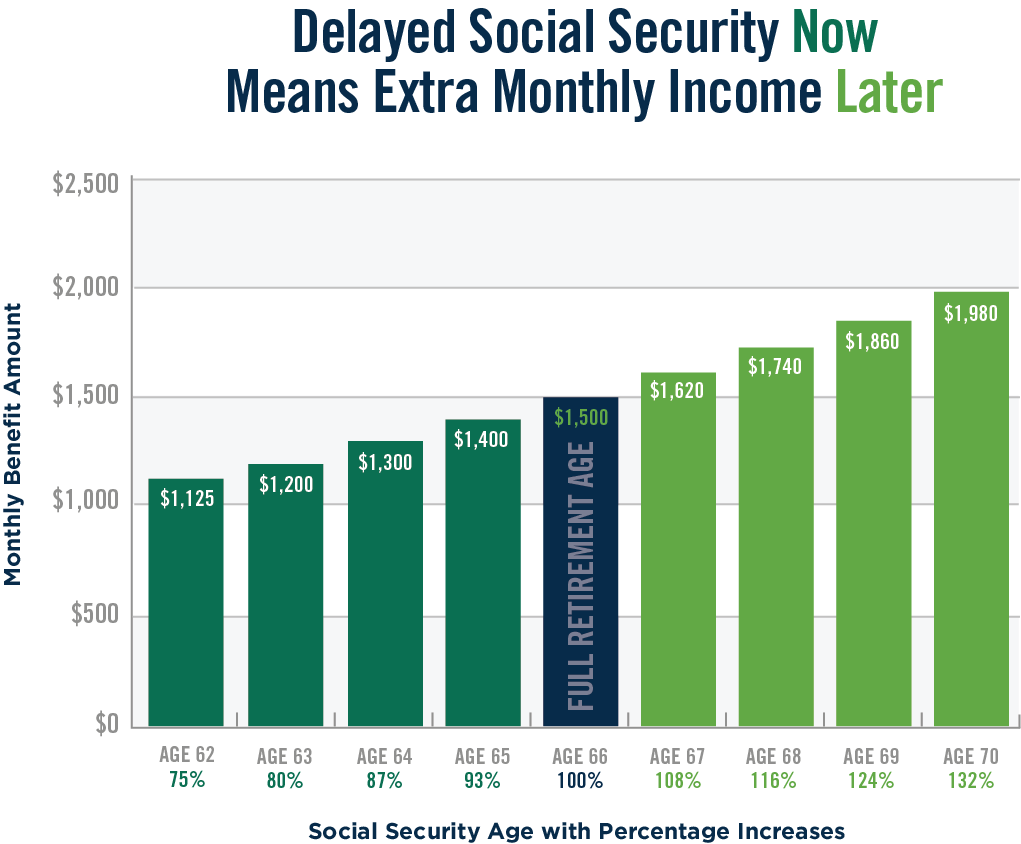

Although you can start drawing Social Security at age 62, that doesn’t mean you should. And while many need to withdraw as soon as they are eligible due to financial or health reasons, doing so results in a 25% or more reduction in the benefit amount compared to waiting until Full Retirement Age (FRA), which varies depending on your year of birth.

In fact, for each year you wait to begin receiving Social Security between your FRA and age 70, the benefit percentage increases by 8% — which may be a better decision in the long run. It all depends on your unique circumstances.

Let’s say your monthly benefit from Social Security shook out to be $1,500 a month at the full retirement age of 66. If you take it at age 62, you are giving up 25% of payments that are rightfully yours. If you wait until age 70, you gain an extra 32% of income. Again, if you can wait, you should.

Keep in mind that Social Security is only one piece of the larger retirement puzzle.

Unfortunately, many Americans look to Social Security as the main key to their future income when it should be just part of a larger equation.

Although Social Security is a significant benefit, it is wise to view it as a supplement to a well-prepared retirement plan — not as a complete retirement plan itself — especially since the full funding status of Social Security is a topic that our elected officials must address in the future.

So what does this all mean for you as you near retirement?

For most retirees with adequate savings, the best strategy is to wait to collect Social Security benefits until either FRA or age 70.

But if you need to start withdrawing earlier, make sure you have a monthly budget based on all your retirement income and stick to it!

Get a pulse on your Social Security estimates so you can begin planning your retirement income strategy.

If you’re unsure where your Social Security benefit amount stands, the Social Security Administration (SSA) encourages individuals to create a secure online account through a my Social Security account to access their information and Social Security statements at any time.

Reviewing these statements may be helpful in estimating a potential income gap in the future. Once you know this information, this input will be vital as you map out a retirement income strategy. GuideStone® offers different retirement income resources and tools for you to use within your MyGuideStone® account.

Quick Recap:

If you have further questions, contact a customer solutions specialist at 1-888-98-GUIDE (1-888-984-8433) Monday through Friday between 7 a.m. and 6 p.m. CT.