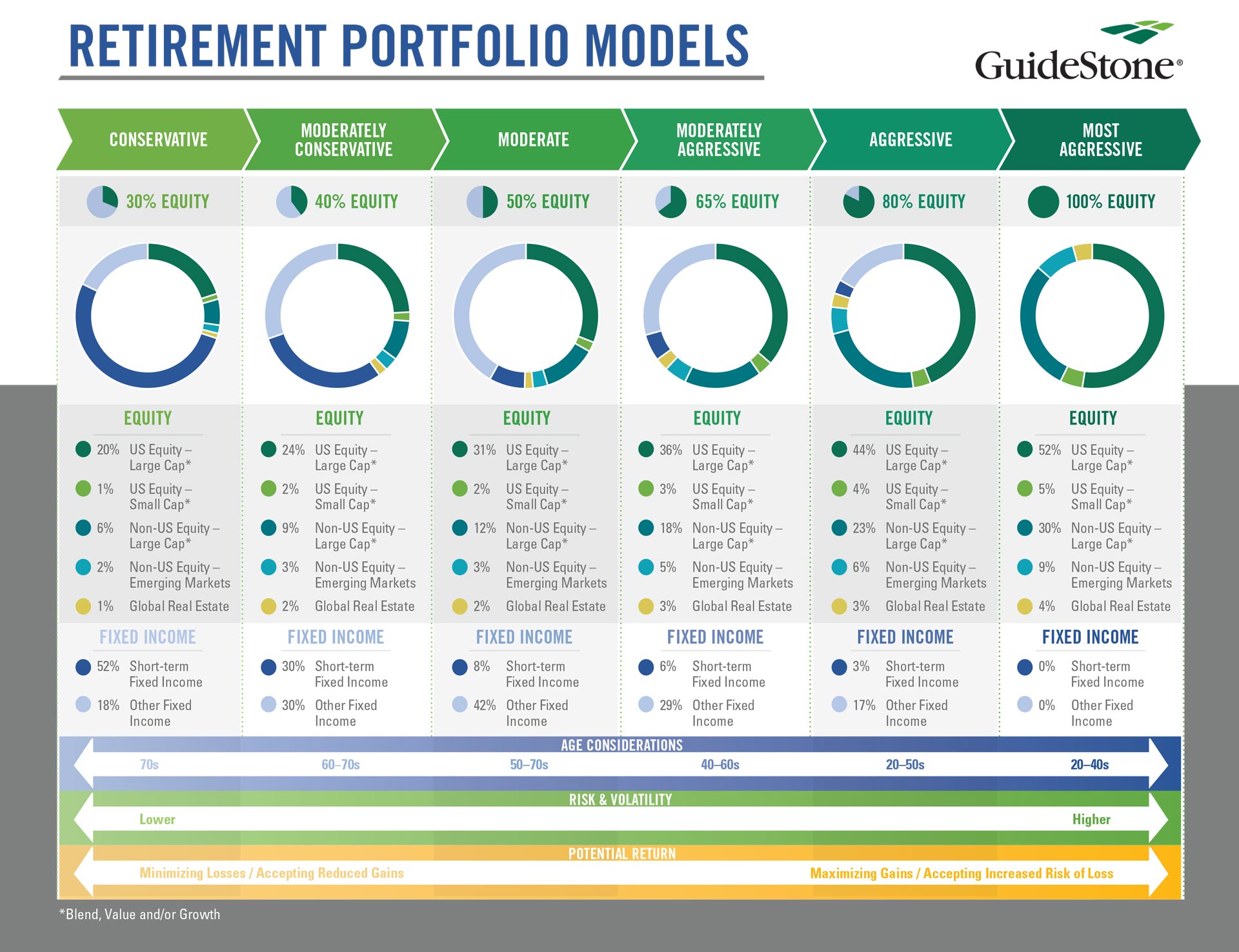

As an investor who is generally comfortable choosing your own funds, you may enjoy the freedom of independently building your own portfolio from scratch. But for investors who would like a bit more structure, GuideStone® offers portfolio models designed to help you direct your investment selections at the major asset class level.

Specifically designed as an asset allocation approach, our sample portfolio collection delivers structured alternatives to channel your fund choices into different major asset categories such as U.S. and non-U.S. equities, fixed income and cash. Once you select one of the following models, you can incorporate the funds available through your retirement plan in accordance with your model’s asset class framework.

For a comprehensive look across your time horizon and risk tolerance, download the chart below: